In the bustling world of personal finance, understanding the nuances of your financial health can make a world of difference. One of the pivotal metrics in this landscape is your CIBIL Score—a three-digit number that can significantly impact your financial journey. While you might be familiar with its importance, the act of checking your CIBIL Score regularly remains an often overlooked practice. Let’s delve into why this seemingly simple habit can be the ticket to saving—and even making—money.

Understanding the CIBIL Score

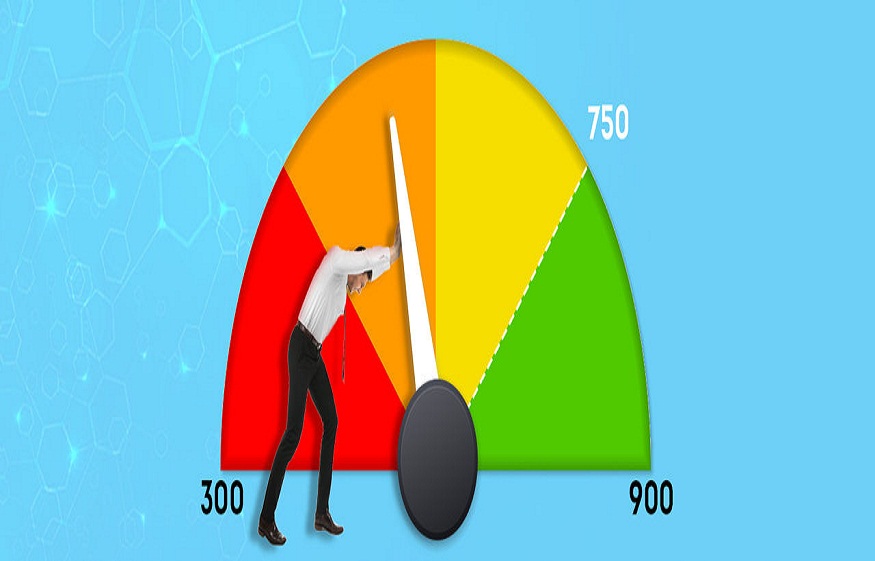

The CIBIL Score—ranging from 300 to 900—is a numerical summary of your credit history, generated by TransUnion CIBIL, the leading credit information company in India. This score is used by lenders to assess your creditworthiness. A higher score indicates a reliable borrower, while a lower score could raise red flags.

Think of your CIBIL Score as your financial report card. Just like how a school report reflects a student’s performance, your CIBIL Score is a reflection of how well you manage your finances.

The Importance of Checking Your CIBIL Score

Be Informed, Be Empowered

By regularly checking your CIBIL Score, you empower yourself with crucial information. It’s akin to regularly consulting your GP for health check-ups; the earlier you know if something’s awry, the better equipped you are to handle it.

Anticipate Potential Financial Hurdles

Monitoring your score allows you to anticipate and circumvent potential financial hurdles. Say you’ve been eyeing a home loan – a surprise drop in your score could mean higher interest rates. Addressing these issues beforehand could save you thousands over the tenure of your loan.

How the CIBIL Score Calculator Can Help

To keep tabs on your score without hassle, using a CIBIL Score Calculator is a smart move. These calculators provide quick insights into your financial standing and help forecast potential changes based on hypothetical financial decisions.

Real-World Application

Imagine planning to buy a new car. You’re offered an enticing loan at 9% interest. By using a CIBIL Score Calculator, you discover that improving your score by even 50 points could secure a better rate of 7%. Over a five-year loan period, this simple improvement could save you a significant sum.

Hidden Costs of an Ignored CIBIL Score

Higher Interest Rates

A low CIBIL Score often translates to higher interest rates on loans and credit cards. It’s similar to paying a premium for insurance due to perceived higher risk. Regular checks enable you to manage and potentially improve your score, lowering borrowing costs.

Limited Access to Credit

A neglected score might mean declined loan or credit card applications. More often than not, a regular check could alert you to areas needing improvements and prevent these hurdles.

Impact on Employment

Surprisingly, some employers review CIBIL Scores as a measure of reliability. A misstep here, visible through a score check, can cost you lucrative job opportunities.

Steps to Regularly Check Your CIBIL Score

Set a Routine Check

Make checking your CIBIL Score as regular as your monthly bill payments. Many people use reminders on their smartphones to ensure they don’t miss it.

Use Reliable Platforms

Utilise trusted services to fetch your score. Regular updates on your financial health come without affecting your score negatively.

How Checking Your CIBIL Score Saves Money

Better Financial Planning

Engaging with your score cultivates a proactive approach to personal finance management. This knowledge allows you to strategically plan for expenses, investments, and savings, maximising returns and minimising unnecessary costs.

Negotiating Power

A strong CIBIL Score can be leveraged when negotiating loan rates. It’s akin to bargaining at a market—armed with knowledge and confidence, you’re likely to snag the best deals.

Avoidance of Penalties

Regular score monitoring can highlight pending or missed payments. Avoiding penalties that accrue from late payments is a direct saving.

Real-Life Analogies: A Case Study

Consider the case of Rohan, a 35-year-old IT professional. Initially indifferent to his credit score, Rohan’s negligence resulted in paying high interest on a personal loan. Motivated to improve, he began checking his CIBIL Score regularly. Over a year, his score improved by 100 points. This improvement allowed him to refinance his loan at a reduced rate, saving him around ₹50,000 in interest.

Rohan’s case exemplifies how routine CIBIL Score checks can be a game-changer in financial planning.

Common FAQs About CIBIL Score

Can checking my CIBIL Score regularly lower it?

No. This is a common myth. Ensuring regular checks through soft inquiries does not impact your score.

How frequently should one check their score?

It’s wise to monitor your score monthly or, at the least, quarterly. Regularity ensures errors are caught early and improvements tracked.

Conclusion: Your Financial Well-being

Checking your CIBIL Score may seem mundane, but it is a cornerstone of financial well-being. Much like a seasoned driver who regularly checks their car’s efficiency, maintaining an updated view of your credit score ensures that your financial journey remains smooth and secure. Equip yourself with tools like the CIBIL Score Calculator to transform this into an enriching habit rather than a chore.

Knowing your CIBIL Score gives you control—not just saving money but opening pathways to richer, more informed financial decisions. In the tapestry of personal finance, your CIBIL Score is a single thread, but one whose influence can weave a future of stability and prosperity. Regularly check it, nurture it, and allow it to work to your advantage. So, are you ready to take control today? Start a routine, and your pocket will thank you!